COSTA MESA, Calif., Nov. 13, 2017 /PRNewswire/ -- Digital auto loan applications have the power to increase customer satisfaction, but wide variance in the execution of the digital application process has created a significant performance gap between top and bottom performing lenders, according to the J.D. Power 2017 U.S. Consumer Financing Satisfaction Study,SM released today. The top-performing mass market and luxury lenders rate significantly higher than the lowest performers (8.75 vs. 7.93 and 8.85 vs. 7.54, respectively, on a 10-point scale) in the most heavily weighted website attribute in the study: range of services that can be performed online.

"With such erratic approaches to digitalization, many auto lenders are failing to successfully capitalize on tremendous cost-cutting opportunities that have proven to boost customer satisfaction," said Jim Houston, Senior Director of Automotive Finance at J.D. Power. "With some lenders varying widely on ease-of-use satisfaction scores for their digital offerings, a huge opportunity is going unmet by many."

Following are key findings of the study:

- Digital loan applications generate significantly higher satisfaction—for some: While the digital application channel generates significantly higher levels of overall satisfaction among both mass market and luxury customers, many are waiting longer for a credit decision than those utilizing dealer representatives. Just 30% of customers applying online received a credit decision within 15 minutes vs. 46% who filled out a paper application with a dealer.

- Time given to make first payment provides greatest impact on onboarding experience: High-ranking mass market and luxury lenders perform highest on time given to make first payment, allowing an average lead time of 21.2 days for mass market customers and 18.4 days for luxury customers prior to first payment due date.

- Autopay and Web-based payment drive highest customer satisfaction: Mass market customers paying by hard-copy check are significantly less satisfied than those using autopay (800 vs. 851, respectively, on a 1,000-point scale).

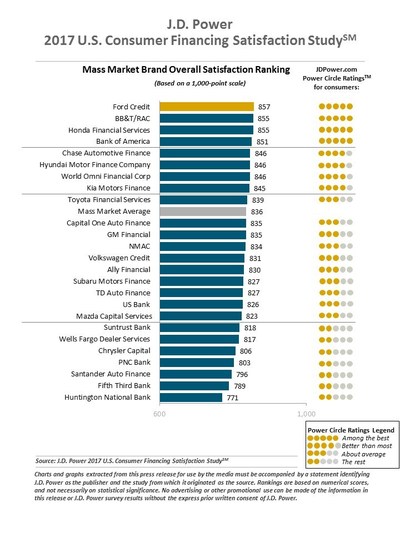

Study Rankings

Lincoln Automotive Financial Services ranks highest among luxury brands, with a score of 890. Lexus Financial Services (875) ranks second and Acura Financial Services (869) ranks third.

Ford Credit ranks highest among mass market brands, with a score of 857. BB&T/RAC (855) ranks second and Honda Financial Services (855) ranks third.

The 2017 U.S. Consumer Financing Satisfaction Study measures overall customer satisfaction in four factors (listed alphabetically): billing and payment process; onboarding process; phone contact; and website. Satisfaction is calculated on a 1,000-point scale. The study is based on responses from more than 14,500 customers who financed a new- or used-car loan or lease within the past four years and was fielded in July-August 2017.

See the online press release at http://www.jdpower.com/pr-id/2017207.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power is headquartered in Costa Mesa, Calif., and has offices serving North/South America, Asia Pacific and Europe. J.D. Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer.

Media Relations Contacts

Geno Effler; Costa Mesa, Calif.; 714-621-6224; [email protected]

John Roderick; St. James, N.Y.; 631-584-2200; [email protected]

About J.D. Power and Advertising/Promotional Rules www.jdpower.com/about-us/press-release-info

SOURCE J.D. Power

Share this article