Deloitte CFO Signals™ Survey: All Eyes on Next US Administration; Majority Expect Less Congressional Gridlock and Substantial Policy Changes

- Net optimism remains strong at +23.4 compared with +19.7 last quarter; however, all four company growth expectation metrics are near survey lows

- Uncertainty about impact of new US administration is among CFOs' most worrisome external risks

- Two-thirds of CFOs agree industry-skilled talent will be difficult to acquire; 67 percent agree wage increases will be necessary to secure and retain highly skilled workers

NEW YORK, Jan. 5, 2017 /PRNewswire/ -- Deloitte's fourth quarter (4Q 2016) CFO Signals survey, which opened the day after the election on Nov. 9, 2016, reveals that all eyes are on the next U.S. administration, with 73 percent of surveyed chief financial officers expecting less congressional gridlock. Additionally, CFOs generally anticipate substantial policy changes to take place in the next four years in the areas of taxes, repatriation of cash to the U.S., infrastructure investments, health care and immigration:

- Eighty-six percent of CFOs expect the Affordable Care Act to be significantly modified.

- Sixty-six percent expect corporate taxes to decline, and 74 percent say repatriation of cash to the U.S. will become more attractive.

- Fifty-three percent of CFOs foresee meaningful immigration reform legislation.

- Sixty-nine percent of CFOs anticipate substantial new infrastructure investments and overwhelmingly expect the national debt to rise.

By contrast, less than 10 percent of the surveyed CFOs predict Congress will pass trade deals with either Europe or Asia respectively.

"CFOs appear to be anticipating substantial changes in policy which will certainly affect their companies. As the new administration's agenda unfolds and CFOs gain more clarity, it will be interesting to see how CFOs' optimism and expectations change," said Sandy Cockrell, national managing partner of the U.S. CFO Program, Deloitte LLP. "For example, despite appearing to be fairly bullish on North America's economy—and U.S. CFOs indicating higher optimism about their own companies' prospects than in the last two years—there are concerns about topics, such as tax uncertainty and the possibility of a rising national debt."

This quarter reveals a sharp contrast between rising optimism regarding own company prospects and all four business outlook metrics tracked by the CFO Signals survey for 27 consecutive quarters. Net optimism in 4Q 2016 remains strong at +23.4, and 43 percent of CFOs express rising optimism about their own companies' prospects, up from 35 percent last quarter. Net optimism for the U.S. also rose sharply from last quarter's +16.0 to +34.0 this quarter.

On the other hand, CFO expectations for growth in revenue, earnings, capital spending and domestic hiring all remain near their survey lows.

- Year-over-year revenue growth expectations of 3.7 percent are down from last quarter's reading of 4.2 percent, among the lowest in survey history.

- Earnings growth expectations of 6.4 percent are up slightly from last quarter's 6.1 percent, but still near their survey low.

- Growth expectations of 3.6 percent in capital investment are down sharply from last quarter's 5.6 percent and remain the second-lowest in survey history.

- Domestic hiring growth also fell from last quarter's strong showing of 2.3 percent to 1.3 percent, slightly below its two-year average.

In particular, U.S. CFOs' expectations for revenue, earnings and capital investment all came in near historic survey lows.

Each quarter, CFOs are also asked which risks they regard as most worrisome. The top three external risks CFOs cited this quarter are: 1) uncertainty about the new administration; 2) a tie between the impact of protectionism on global trade and global growth/recession; and 3) new/burdensome regulation. Like last quarter, securing qualified talent tops the list of internal risks cited, followed by execution of strategies and plans in second place, and retaining key employees and controlling costs and expenses, tied for third.

When asked about expectations for the macroeconomic environment in 2017, 58 percent of U.S. CFOs agree that the U.S. economy will improve over the next year, but only 14 percent of Canadian CFOs expect their economy to improve. No Mexican CFOs expect better conditions for Mexico's economy.

In their assessment of broader regional economies, 43 percent of CFOs say current conditions in North America's economy are good compared to 46 percent last quarter, while 58 percent expect better conditions in a year, up from 37 percent last quarter. Eight percent of CFOs perceive Europe's current economy as good, up from 4 percent last quarter; 13 percent expect better conditions a year from now, slightly higher than last quarter's 10 percent. Perceptions of China's economy improved with 24 percent of CFOs describing it as good, up from 10 percent last quarter, and 17 percent expecting conditions to improve, up from 14 percent last quarter.

When asked about their industry expectations in 2017, surveyed CFOs are mostly optimistic about their industries' growth, with 54 percent expecting their revenue to grow, and more than half anticipating technology advances to be a major factor in changing both industry products and services and how their industry operates. Sixty-six percent of CFOs expect that industry-skilled talent will be difficult to acquire, and 67 percent believe wage increases will be necessary to secure and retain highly skilled workers.

"This quarter's findings show high industry and country variability in sentiment and expectations," commented Greg Dickinson, managing director, Deloitte LLP, who leads the North American CFO Signals survey. "But expectations were very diverse even within particular regions and industries, which seems to indicate inconsistent ideas about how the new administration will proceed and how worldwide markets will respond."

Additional findings from the Deloitte 4Q 2016 CFO Signals survey include:

- Equity markets overvalued, and debt attractiveness still high. With equity markets at or near their historic highs, 70 percent of surveyed CFOs say U.S. equity markets are overvalued. Seventy-nine percent of CFOs say debt financing is attractive, down from 89 percent last quarter.

- CFOs expect their range of products and services to expand and to hire more highly skilled workers. Fifty-nine percent say their product/service scope will expand, but CFOs are mostly split when it comes to focusing on new or existing customers and offerings. Fifty-six percent of CFOs expect to hire more highly skilled than lower-skilled workers, but they are split on whether they will hire more people than they let go.

- Majority expect labor costs to increase, interests rates to rise and a strong dollar. Sixty-seven percent of surveyed CFOs expect labor costs to increase, and CFOs largely anticipate interest rates to rise above 0.5 percent before the end of 2017. Many CFOs also foresee a continuing strong dollar with little expectation that the other major currencies will appreciate against it.

"CFOs' views about the changing economic environment are similar to those of economists, as reflected in Deloitte's recent US Economic Forecast," says Danny Bachman, senior U.S. economist, Deloitte Services LP. "The unexpected results of the presidential election have introduced greater uncertainty about policy in areas such as trade, infrastructure spending, taxes and regulation - with an unusually wide range of possible impacts for business."

Deloitte's fourth-quarter 2016 CFO Signal's survey also provides CFOs' responses on business focus priorities, expectations for capital, strategy and leadership, and more. To download a copy of the survey, please visit: www.deloitte.com/us/cfosignals2016Q4.

About The Deloitte CFO Signals™ survey

Each quarter, CFO Signals tracks the thinking and actions of CFOs representing many of North America's largest and most influential organizations. This report summarizes CFOs' opinions in four areas: business environment, company priorities and expectations, finance priorities and CFOs' personal priorities.

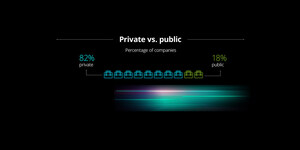

The Deloitte CFO Signals survey for the fourth quarter of 2016 was conducted during the two-week period opening Nov. 9 and ending Nov. 23, 2016. A total of 137 CFOs responded during this time. Seventy-two percent of respondents are from public companies, and 84 percent are from companies with more than $1 billion in annual revenue. For more information, please see the report.

For more information about Deloitte's CFO Signals, or to inquire about participating in the survey, please contact [email protected].

About Deloitte's CFO Program

The CFO Program brings together a multidisciplinary team of Deloitte leaders and subject matter specialists to help CFOs stay ahead in the face of growing challenges and demands. The program harnesses our organization's broad capabilities to deliver forward thinking and fresh insights for every stage of a CFO's career—helping CFOs manage the complexities of their roles, tackle their organization's most compelling challenges and adapt to strategic shifts in the market. For more information about Deloitte's CFO Program, please contact [email protected] or visit www.deloitte.com/us/thecfoprogram.

As used in this document, "Deloitte" means Deloitte LLP and its subsidiaries. Please see www.deloitte.com/us/about for a detailed description of the legal structure of Deloitte LLP and its subsidiaries. Certain services may not be available to attest clients under the rules and regulations of public accounting.

SOURCE Deloitte

Related Links

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

Newsrooms &

Influencers

Digital Media

Outlets

Journalists

Opted In

Share this article